Loans Ontario: Navigating the Puzzle of Financial Opportunities

Wiki Article

Navigate Your Financial Journey With Reputable Financing Services Designed for Your Success

In the vast landscape of financial monitoring, the course to accomplishing your goals can commonly seem challenging and complex. With the best support and assistance, navigating your monetary journey can end up being a more workable and successful endeavor. Reputable car loan services tailored to satisfy your certain needs can play a crucial duty in this process, supplying an organized strategy to safeguarding the necessary funds for your ambitions. By comprehending the intricacies of different loan options, making educated choices throughout the application process, and effectively handling settlements, people can take advantage of car loans as tactical tools for reaching their economic milestones. How precisely can these solutions be optimized to ensure long-term economic success?

Comprehending Your Financial Demands

Understanding your economic requirements is critical for making notified decisions and attaining monetary stability. By making the effort to evaluate your economic scenario, you can recognize your short-term and lasting goals, create a budget plan, and establish a strategy to get to monetary success. Begin by examining your income, properties, expenditures, and financial debts to get a detailed understanding of your monetary standing. This analysis will help you identify just how much you can pay for to conserve, spend, or designate towards car loan payments.In addition, understanding your monetary needs includes acknowledging the difference between essential expenditures and optional costs. Prioritizing your needs over desires can assist you manage your funds better and avoid unneeded debt. In addition, consider aspects such as emergency situation funds, retirement planning, insurance protection, and future financial objectives when evaluating your monetary needs.

Discovering Lending Choices

When considering your economic needs, it is vital to explore different funding options offered to establish one of the most appropriate option for your specific conditions. Understanding the different kinds of car loans can help you make informed choices that line up with your economic objectives.One typical type is a personal car loan, which is unsafe and can be used for different functions such as debt loan consolidation, home renovations, or unexpected expenses. Individual fundings generally have dealt with rates of interest and monthly payments, making it less complicated to budget.

An additional choice is a guaranteed funding, where you supply security such as an auto or residential or commercial property. Safe finances commonly come with reduced rates of interest due to the decreased threat for the loan provider.

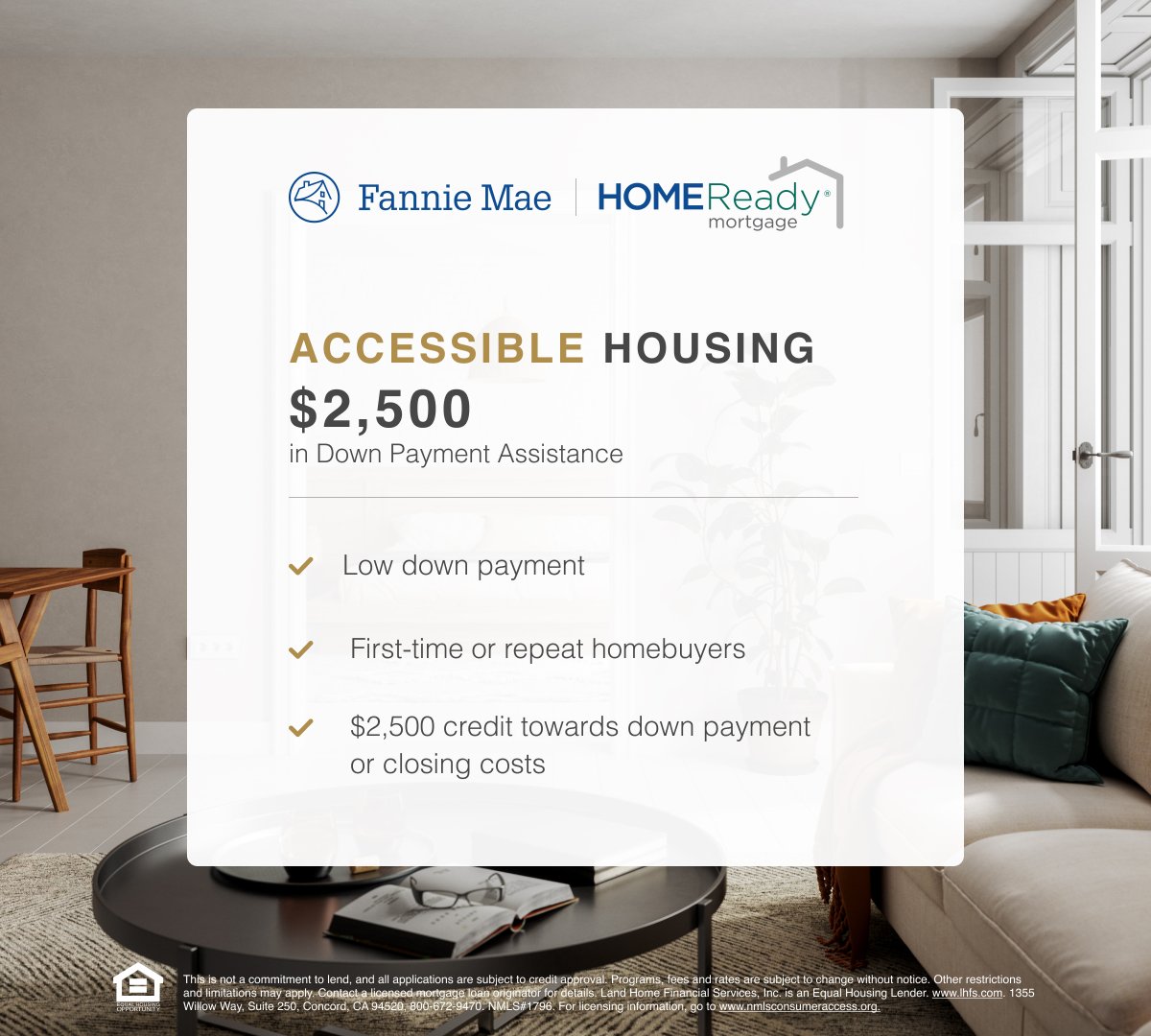

For those seeking to purchase a home, a home loan is a prominent choice. Mortgages can differ in terms, rate of interest, and deposit needs, so it's important to check out various loan providers to discover the finest suitable for your circumstance.

Using for the Right Finance

Browsing the procedure of applying for a finance demands a complete analysis of your monetary demands and persistent research into the offered choices. Begin by assessing the purpose of the loan-- whether it is for a major acquisition, debt loan consolidation, emergencies, or various other needs.Once you've identified your monetary needs, it's time to explore the finance items supplied by various loan providers. Contrast passion prices, repayment terms, costs, and qualification standards to find the loan that ideal matches your needs. Furthermore, think about elements such as the lending institution's track record, client service top quality, and online devices for managing your funding.

When obtaining a financing, guarantee that you offer exact and complete information to accelerate the authorization procedure. Be prepared to submit documentation such as evidence of earnings, identification, and monetary statements as needed. By carefully selecting the ideal funding and finishing the application diligently, you can establish on your own up for monetary success.

Taking Care Of Finance Payments

Efficient administration of funding repayments is vital for keeping economic security and conference your obligations properly. To effectively take care of finance repayments, start by creating a thorough budget plan that details your earnings and expenses. By plainly identifying exactly how much you can allot in the direction of funding payments each month, you can make sure timely repayments and avoid any type of financial stress. Establishing up automatic repayments or suggestions can likewise assist you remain on track go now and prevent missed out on or late repayments.Several economic institutions supply alternatives such as lending deferment, forbearance, or restructuring to assist consumers dealing with financial difficulties. By actively managing your car loan payments, you can maintain economic health and wellness and work towards accomplishing your long-lasting economic goals.

Leveraging Fundings for Financial Success

Leveraging fundings tactically can be a powerful device in achieving monetary success and reaching your long-term goals. When utilized wisely, lendings can provide the needed funding to purchase opportunities that may produce high returns, such as beginning a company, seeking higher education, or spending in genuine estate. loan ontario. By leveraging loans, individuals can accelerate their wealth-building procedure, as long as they have a clear prepare for repayment and a comprehensive understanding of the dangers involvedOne secret element of leveraging car loans for economic success have a peek at these guys is to thoroughly evaluate the conditions of the car loan. Understanding the rate of interest rates, settlement timetable, and any type of involved fees is critical to make certain that the funding aligns with your monetary goals. Additionally, it's necessary to obtain just what you require and can sensibly pay for to settle to avoid coming under a financial debt catch.

Conclusion

By recognizing the ins and outs of various financing choices, making notified choices throughout the application process, and properly handling payments, people can take advantage of lendings as calculated tools for reaching their economic milestones. loans ontario. By actively handling your loan repayments, you can preserve financial health and wellness and visit this site right here job in the direction of attaining your long-term economic objectives

One key facet of leveraging financings for financial success is to carefully analyze the terms and problems of the funding.In final thought, comprehending your monetary needs, discovering finance options, applying for the best funding, taking care of lending payments, and leveraging fundings for financial success are critical actions in navigating your monetary trip. It is crucial to very carefully take into consideration all aspects of loans and economic choices to guarantee long-term financial security and success.

Report this wiki page